Apollo 11 Astronauts Signed Autographs as Life Insurance

You've probably heard countless stories about the Apollo 11 mission, but here's one that reveals the human side of these space pioneers. When Neil Armstrong, Buzz Aldrin, and Michael Collins prepared for their historic journey to the Moon, they couldn't secure traditional life insurance. Instead, they devised an ingenious backup plan for their families' financial security – one that turned simple signatures into a safety net. Their creative solution speaks volumes about both the risks they faced and their resourceful spirits.

The High-Stakes Mission That Changed History

As NASA prepared for humanity's greatest journey, the Apollo 11 mission carried unprecedented stakes and challenges that would test the limits of human ingenuity.

When the circuit breaker broke during the moonwalk, quick thinking and resourcefulness proved essential to their safe return.

On July 16, 1969, astronauts Neil Armstrong, Michael Collins, and Buzz Aldrin set out from Cape Kennedy to achieve President Kennedy's bold national goal: complete the first lunar landing and return safely to Earth.

You'll find the mission's historical significance reflected in every careful detail, from the Command Module Columbia to the Lunar Module Eagle. The crew traveled nearly 1,000,000 miles during their historic eight-day journey.

The crew faced intimidating technical hurdles, including computer overloads and fuel concerns, yet their quick thinking and adaptability prevailed.

When Armstrong took manual control to navigate past hazardous terrain, he demonstrated the perfect blend of human skill and technological advancement that would make this pioneering lunar landing possible.

Why Traditional Insurance Wasn't an Option

While space exploration captivated the world's imagination, traditional insurance companies wouldn't touch the Apollo missions with a ten-foot pole. The insurance challenges were immense – with no historical data to assess astronaut risks accurately, even Lloyd's of London, famous for insuring unique risks, refused coverage.

NASA faced multiple obstacles: they were legally barred from providing insurance, and astronauts' salaries weren't enough to afford the sky-high premiums private insurers demanded. The agency's solution came through the creation of Insurance Covers during the 1960s. The crew spent one month quarantined before their historic mission, using this time to sign hundreds of autographs.

The potential payouts wouldn't adequately protect their families either. While some third parties offered to cover premiums in exchange for publicity, these arrangements proved inconsistent and often inadequate.

This left astronauts in a precarious position, forcing them to seek creative alternatives to guarantee their families' financial security if tragedy struck during their dangerous missions.

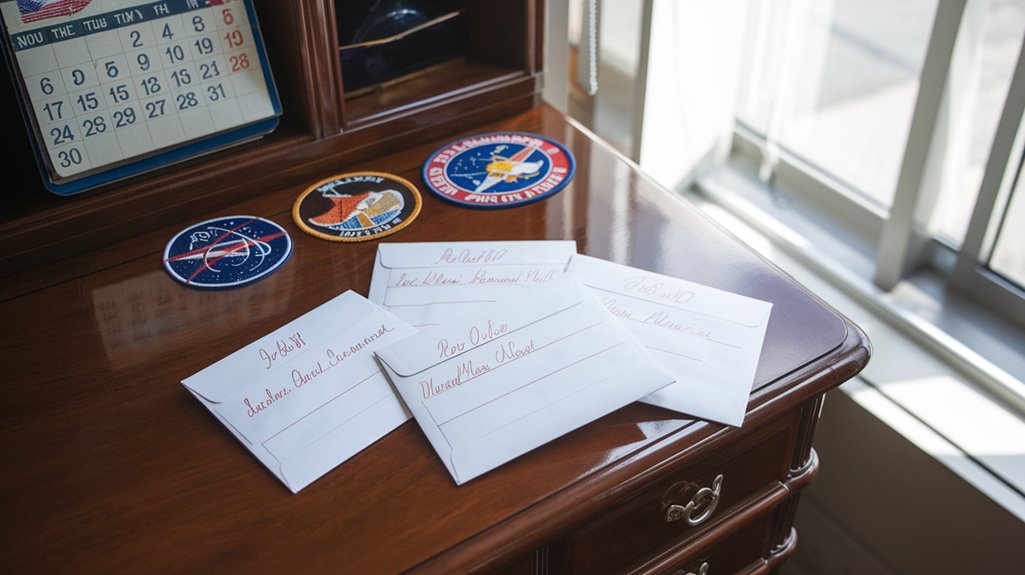

The Creative Solution: Autograph Insurance Covers

Despite lacking traditional insurance options, the Apollo 11 astronauts devised an ingenious solution to protect their families financially. They signed hundreds of autograph insurance covers during their pre-flight quarantine, knowing these signatures would become valuable astronaut memorabilia if tragedy struck.

These special envelopes, postmarked with significant mission dates, served as a makeshift life insurance policy. The astronauts understood there was a robust market for American heroes' autographs, ensuring their families could sell these items for substantial sums if needed. With Armstrong's annual salary of $27,401, this alternative insurance method was crucial for providing financial security.

The practice proved so effective that crews from Apollo 12 through 16 adopted the same strategy. Today, these covers command tens of thousands of dollars at auctions, with autograph authentication experts confirming their historical significance.

They remain a tribute to the astronauts' resourcefulness in protecting their loved ones. The mission's historic moon landing in July 1969 made these autographed covers even more valuable as collectible items.

How the Astronauts Implemented Their Plan

They arranged for a friend to mail these signed envelopes to their families.

- Each envelope received special postmarks on significant mission dates.

- The covers served as proof of authenticity for collectors.

- Their families would sell these valuable autographs if tragedy struck.

This innovative approach addressed their inadequate insurance coverage, as standard policies were prohibitively expensive.

The Mercury Seven astronauts were all denied life insurance coverage by conventional insurers in 1961, setting a concerning precedent.

The astronauts' modest salaries, like Armstrong's $27,401 in 1969, made this alternative solution necessary for their families' security.

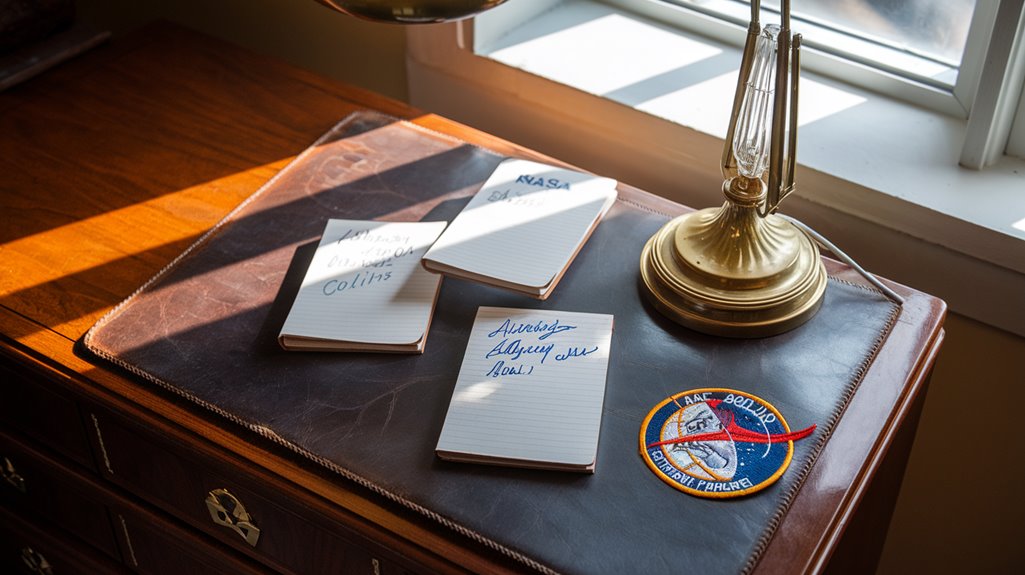

The Value Behind Space Heroes' Signatures

The ingenious insurance strategy created by the Apollo 11 astronauts led to an unexpected legacy in the collectors' market.

Today, signature valuation for these space heroes' autographs reaches impressive heights, with crew-signed photographs selling for up to $14,700.

If you're interested in memorabilia trends, you'll find that condition and provenance greatly impact value. Personalized signatures tend to be less desirable for serious collectors and investors.

Pristine items with well-documented histories command premium prices, while authenticated signatures from reputable experts like Steve Zarelli carry the most weight. Certificates of authenticity provide crucial verification for serious collectors.

You'll see signed lithographs fetching around $10,250, and individual Armstrong signatures can range from $3,500 to $5,000 with motivated bidders.

To protect your investment, you'll need expert authentication, as autopen signatures were common during Armstrong's active astronaut years.

The market especially values items that connect directly to mission milestones, like dated postal covers.

NASA's Stance on Astronaut Protection

Since protecting astronauts remains a top priority, NASA's extensive safety protocols span from pre-flight medical care to emergency launch systems.

You'll find thorough coverage through policies like NPD 8900.3, which guarantees astronaut health monitoring both during active service and after retirement for spaceflight-related conditions.

When it comes to radiation safety, NASA employs multiple protective measures:

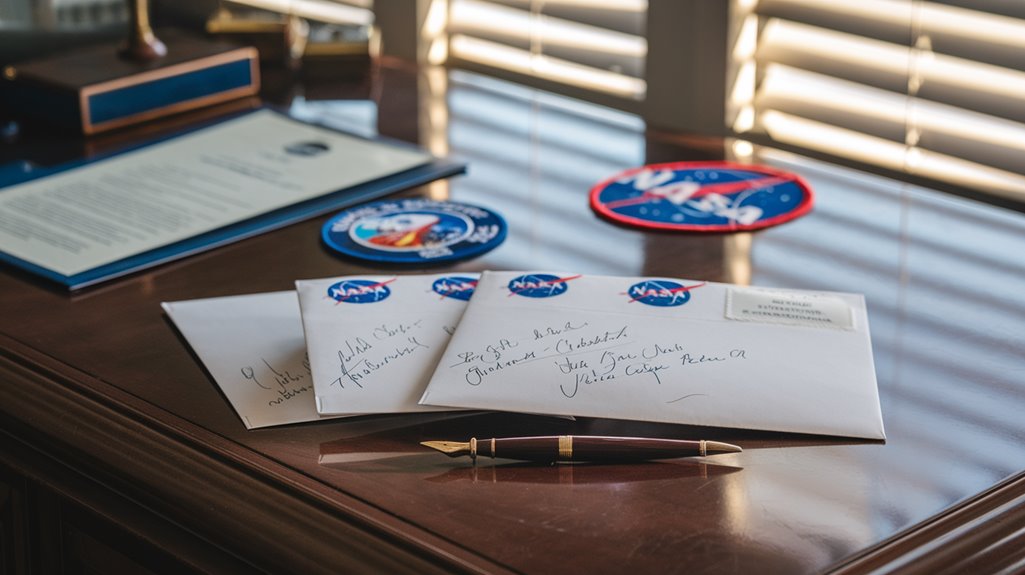

Private insurance companies balked at providing affordable coverage for Apollo astronauts due to unprecedented mission risks and limited actuarial data.

The insurance market struggled to assess the true risks of space travel, resulting in prohibitively expensive premiums that astronauts couldn't afford.

While some companies attempted to offer coverage in exchange for publicity, most astronauts declined these arrangements. A few notable exceptions emerged: Travelers Insurance Co. offered coverage for Apollo 11 with premiums paid by Austral Oil Company, and Frank W. Sharp provided free $100,000 policies to Apollo 13 astronauts through National Bankers Life.

Later, the National Space Club Foundation stepped in to cover premiums for subsequent flights. Despite these offers, the challenge of securing adequate astronaut risk protection led crews to seek alternative solutions, including their now-famous autograph insurance strategy.

Legacy of the Apollo Insurance Covers

Born from necessity and ingenuity, Apollo insurance covers represent one of spaceflight history's most creative financial solutions.

You'll find these unique pieces of insurance memorabilia continue to captivate collectors and space enthusiasts, selling for tens of thousands of dollars since the 1990s.

The astronaut legacy of these covers extends beyond their original purpose as financial protection, now symbolizing:

- The incredible risks early space pioneers faced when conventional insurance wasn't feasible

- Their unwavering commitment to protecting their families' futures

- The innovative spirit that characterized the Apollo program

- The cultural significance of space exploration during the 1960s and early 1970s

Today, these covers stand as powerful reminders of the Apollo era's challenges and the creative solutions that emerged from them, making them highly prized artifacts of space history.

Impact on Future Space Missions

While the Apollo astronauts' autograph insurance strategy proved successful, its impact on future space missions extended far beyond mere financial protection.

You'll find that this innovative approach highlighted significant gaps in risk management for space exploration, forcing NASA and insurance companies to reevaluate their policies.

The practice raised important ethical dilemmas about how we value astronauts' lives and protect their families.

Modern collectSPACE communities continue discussing these historic insurance practices while sharing their own memorabilia experiences.

As space missions evolved, you'd notice that this makeshift insurance strategy prompted the development of more extensive coverage options for space travelers.

The future implications of this practice helped shape modern space mission planning, where risk management now includes robust insurance policies and family protection measures.

Today's astronauts benefit from these improvements, though the original autograph strategy remains a powerful reminder of early space exploration challenges.

Modern Space Travel Insurance Evolution

As commercial space travel evolves from science fiction to reality, the insurance industry faces unprecedented challenges in protecting both vessels and passengers.

The space risk landscape continues to shift as companies like SpaceX and Blue Origin push boundaries, forcing insurance evolution to keep pace with technological advances.

Today's space travel insurance market, valued at nearly $1 billion, offers sophisticated coverage options that you couldn't imagine during the Apollo era.

The market's rapid growth is expected to reach over $6 billion by 2030 as more commercial space flights take place.

Approximately two-thirds of satellites launched globally now carry some form of insurance protection.

Here's how modern policies are developing:

- Specialized underwriters like Lloyd's of London now offer extensive coverage based on multiple factors

- Insurance brokers are creating unique solutions for both vessels and passengers

- Premium costs reflect real-time launch and landing success rates

- Coverage increasingly extends beyond traditional satellite insurance to include space tourism

Lessons From the Apollo Era Insurance Strategy

Despite conventional insurance being unavailable to Apollo 11 astronauts, their innovative "autograph insurance" strategy offers valuable lessons for today's risk management landscape. Their solution demonstrates how creative thinking can overcome seemingly insurmountable regulatory and market barriers.

You'll find that astronaut resilience went beyond physical courage, extending into financial innovation that protected their families. By leveraging their status as American heroes and understanding market demand for space memorabilia, they created a self-insurance mechanism that worked outside traditional financial systems.

Their strategy shows you that when conventional solutions fail, examining your unique assets and market opportunities can lead to effective alternatives. This approach continues to inspire modern risk management, proving that necessity truly drives innovation in protecting against extraordinary risks.