Mark Twain’s Bankruptcy Machine: The Invention That Ruined Him

You might think a celebrated author like Mark Twain would've been too savvy to lose his fortune on a single investment, but that's exactly what happened. When you look at his catastrophic venture with the Paige Compositor, you'll find a cautionary tale about innovation, greed, and blind optimism. The complex typesetting machine didn't just drain Twain's bank account—it forced America's most famous writer into bankruptcy and changed the course of his career forever. Let's unpack how this mechanical monster devoured his dreams.

The Dream of Mechanical Typesetting

While Johannes Gutenberg's printing press had revolutionized the spread of information in the 15th century, the manual process of setting type remained a tedious bottleneck until the late 1800s.

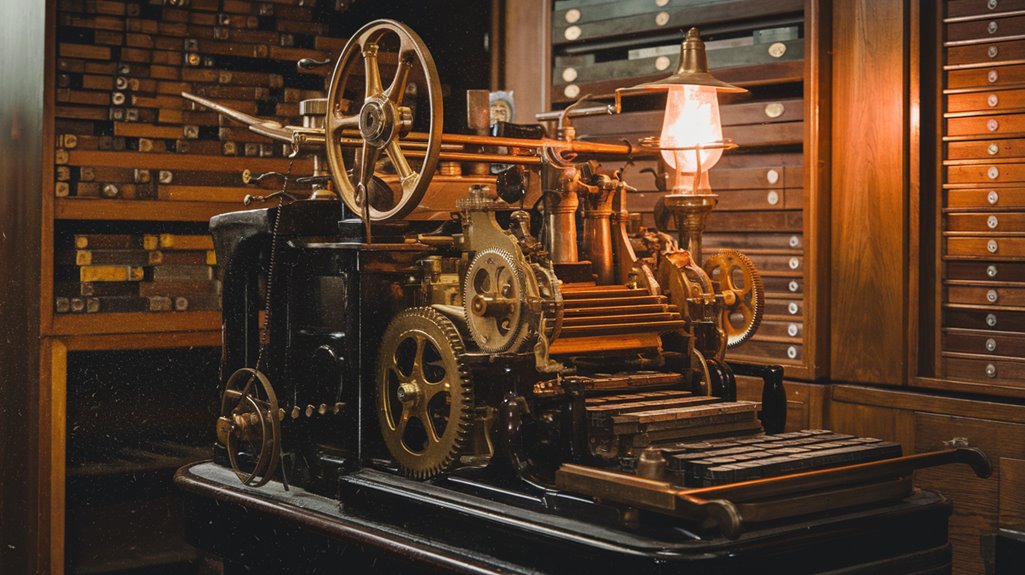

The dream of faster typesetting drove inventors to pursue mechanical innovations that would transform the publishing industry. You'll find that early pioneers like James Paige sought to create machines that could mechanize the entire process, but they often stumbled due to overcomplicated designs. One such machine, known as Paige's Compositor, contained an astounding 18,000 machined parts.

The typesetting evolution gained real momentum when inventors like Ottmar Mergenthaler and Tolbert Lanston developed more practical approaches. These machines utilized a specialized fast-cooling alloy that could be melted and recast repeatedly for maximum efficiency.

Instead of manipulating individual pieces of type, their machines used matrices to cast entire lines or single letters. This simpler principle proved more reliable and economically viable, setting the stage for the modern printing industry you know today.

A $300,000 Gamble on the Paige Machine

Mark Twain's fascination with the Paige Compositor led him to make one of history's most notorious investment blunders.

What started as a modest $5,000 investment in technological innovation quickly spiraled into a staggering $300,000 commitment – equivalent to nearly $10 million today.

You'd think such a massive financial risk would've yielded impressive results, but the machine proved to be an engineering nightmare.

To recover from this devastating loss, Twain toured the globe performing lectures and readings.

With 18,000 parts, including numerous bearings, cams, and springs, the Paige Compositor was absurdly complex. It required constant adjustments and frequently broke down.

Only two were ever built, and they never worked reliably. Meanwhile, the simpler Linotype machine dominated the market. The Compositor's misguided attempt to imitate human motions in its design made it unnecessarily complicated and impractical.

Twain's investment drove him into bankruptcy with $80,000 in debt, though he later repaid every penny despite having no legal obligation.

The Rise of Superior Competitors

Just as the Paige Compositor struggled with its complex design, Ottmar Mergenthaler's Linotype machine swooped in to dominate the printing industry.

With only a fraction of the moving parts and a more reliable design, Linotype gained an immediate competitive advantage in the market.

You can trace the market dynamics that sealed the Paige Compositor's fate: Linotype launched three years earlier, cost considerably less to produce, and proved far more dependable in daily operations.

While Paige's machine contained a staggering 18,000 moving parts that frequently malfunctioned, Mergenthaler's creation offered a simpler, more practical solution. The failed investment led to Mark Twain's 1894 bankruptcy filing. Twain's total investment of over $80,000 in the project proved catastrophic for his finances.

The contrast couldn't have been starker – as Linotype's popularity soared, Paige and Twain's dream machine became obsolete before it could gain any real traction in the marketplace.

From Literary Fame to Financial Ruin

Despite his literary genius and early publishing successes, Twain's financial empire came crashing down in 1894 when he declared bankruptcy, owing $80,000 (roughly $2.4 million today) to over 200 creditors.

His marriage to wealthy coal heiress Olivia Langdon initially provided financial security, but it wasn't enough to offset his poor business decisions.

While his literary legacy remained intact through works like Huckleberry Finn and Grant's memoirs, his financial mismanagement told a different story.

You'll find the roots of his downfall in a series of poor business decisions: investing heavily in the failed Paige Compositor, overpaying authors at his publishing house Charles L. Webster & Co., and publishing questionable works about egg cooking and monkey speech.

His nephew Webster's drug addiction further complicated matters, leading the company to accumulate $94,191 in liabilities against only $69,164 in assets.

The press widely reported his fall from financial grace. Through unwavering determination, he embarked on an ambitious writing and lecture circuit that helped him repay all debts by 1898.

Rogers' Rescue and the Road to Recovery

When bankruptcy loomed over Twain's empire in 1894, Standard Oil executive Henry Rogers stepped in with a strategic plan that would ultimately save the author's financial future.

Rogers' financial strategy began with transferring Twain's assets to his wife, Olivia Langdon, just before filing for bankruptcy in April 1894.

You'll find that Rogers' approach to creditor relations was masterful. He took complete control of Twain's finances and protected his copyrights by moving them to Olivia's name.

Meanwhile, Twain initiated a worldwide lecture tour, earning money through speaking engagements and book sales. Though not legally required, he paid back all confirmed debts, earning praise from editorialists. The author's extensive year-long lecture tour in 1895 took him through British Columbia, Fiji, Australia, New Zealand, and India.

Through Rogers' guidance and his own determination, Twain achieved financial stability and learned valuable lessons about business management. The experience came after his disastrous investment in a failed steam engine that cost him over $40,000.